After the global oil price has fallen almost 70 % since mid-2014, oil exporting countries have felt the impact of the lower prices on growth rates, trade figures and public finances. Despite the negative impacts of the fall in oil prices, the UAE Government remains positive about the country’s economic outlook and diversification policies, which have helped neutralise the impact of the decline in oil prices. The positive side of any crisis is added urgency that comes in the implementation of reforms that help decision-makers reduce economic vulnerabilities in the future. Across the GCC action is being taken in response to the situation through changes in subsidies and fuel pricing, along with efforts for increasing diversification of the economy.

Since the UAE was formed in 1971, the diversification of the economy away from petroleum has been a clearly stated government policy. The UAE has become a global financial and major trading centre, a location of choice for multinational operations, along with a heavily desired tourist destination. Investments in non-energy sectors, such as infrastructure and technology, along with a rapidly recovering real estate sector, continue to provide the UAE with a buffer against oil price decline and global economic stagnation.

According to the World Trade Organization in its latest June 2016 Trade Policy Review, the UAE has continued its policy of diversifying its economy, which helped it overcome the global financial crisis that began in 2008, and the repercussions of falling oil prices that began in 2014. The UAE continues to pursue a strategy of diversification concentrating on high technology sectors and high growth sectors. The share of non-hydrocarbon in the UAE total GDP has continued to rise to exceed 69% today against 53% back in 2000. Dubai is now a services and a trade hub for the region, while the economic diversification strategy in Abu Dhabi continues to rely on manufacturing, petrochemicals and renewable energy.

Economic diversification for sustainable and inclusive growth

A report from the International Monetary Fund (IMF) shows that many empirical studies have documented a strong association between economic diversification and the achievement of sustainable economic growth. A diversified economy based on several sources of income is more resilient and able to recover from different shocks as any deficiency in a particular sector can be alleviated through the performance of other sectors. Achieving economic diversification in resource rich countries is a difficult task; a matter more difficult in relation to oil. Diversification strategies implemented in many countries have not been successful, and historical experience offers few examples of countries that have been able to successfully diversify away from oil, particularly when their oil production horizon is still long. A number of key obstacles often hinder diversification, including the economic volatility that is induced by the reliance on oil revenues, the corroding effect that oil revenues have on governance and institutions, and the risks that oil revenues lead to overvalued real exchange rates. Success or failure appears to depend on the implementation of appropriate policies ahead of the decline in oil revenues. Many oil-exporting countries (for example, Algeria, Congo, Ecuador, Gabon, the GCC countries, Nigeria, Venezuela) have had limited success in diversification. On the other hand, Malaysia, Indonesia, and Mexico perhaps offer the best examples of countries that have been able to diversify away from oil, while Chile has had some success in diversification away from copper.

Indeed, while each country followed its own path in diversification, a number of common themes are evident in diversification successes. First, diversification took a long time and took off only when oil revenues began to dwindle. For example, Malaysia started its export-oriented strategy in the early 1970s and experienced rapid growth in export sophistication in the 1980s–90s. It took more than 20 years to reach a level of sophistication comparable to some advanced economies. Second, successful countries focused on creating incentives to encourage firms to develop export markets and to support workers in acquiring the skills and education to get jobs in these new expanding areas.

UAE Economic Performance after the 2021 Vision

The Government of the UAE seeks to attain sustainable development through the implementation of UAE Vision 2021. Trade is one of the essential elements of the strategy. In line with the strategy, the following initiatives are pursued:

The most important goal of the Government is to attain balanced and sustainable economic growth by creating a business-friendly environment. This declines: a sound foreign trade policy regime, development of national industries, innovation and R&D, promotion of exports, promotion of investment, regulation of competition, promotion of small and medium enterprises, protection of consumers and intellectual property rights, and diversification of the economy.

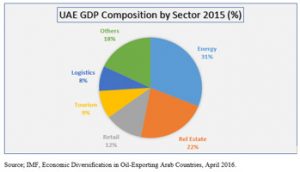

Currently, the UAE’s economy is one of the most diversified among the GCC countries. This can be seen in the decline in the share of oil and gas in its GDP from 41% in 2000 to 31% in 2015, and over 400% increase in industrial infrastructure spending. This is seen predominately in the aviation, aerospace and defence sectors over the past five years. Diversification trends are evident in the rising share of services and financial sectors in the GDP. Beyond this as mentioned the huge investments in education, healthcare, water, communications, transportation, tourism, and other non-hydrocarbon sectors. As part of Vision 2021, the energy sector diversification is facilitated by investment in renewable and alternative energy sources such as solar, carbon capture and storage, and clean technology.

All indicators currently confirm the stability of the UAE economy and its potential to thrive, even becoming a major economic centre for the region and an international maritime and aviation hub that connects the East to the West. The successes being witnessed are the result of a number of integrated factors – political stability, security, advanced infrastructure, and an enabling legislative environment. All these factors helped the UAE to achieve truly remarkable growth rates as shown above and its ranking across a number of international indices. Within this context, the UAE ranked 16th in the World Economic Forum’s Enabling Trade Index 2014 and 1st in terms of availability and quality of transport infrastructure.

The UAE’s economic performance after the recent dramatic drop in oil prices proved its resilience and ability to accommodate market changes. Principally due to the UAE market having strong infrastructure, technology and logistics capabilities. According to the World Travel and Tourism Council, the hospitality sector will continue to see a number of key developments and investment, with some of the largest international hotelier brands now in the UAE, the tourism sector contributed by 9% of the GDP in 2015. The UAE’s airlines are also expected to show positive and stable growth and support the tourism and hospitality market. The World Expo 2020 is expected to play an important role boosting the activity of the tourism sector. The six-month event is expected to attract around 25 million visitors, which will not only serve Dubai’s tourism and hospitality sector, but can extend to further emirates whereby some tourists visit more than one location. Developments in the tourism sector will support the country along with its overall strategy of diversifying the economy. All of these projects will continue to support the country’s economic diversification, and underscore the UAE as a central hub of the Middle East and internationally for innovation, excellence and the investors market of choice.

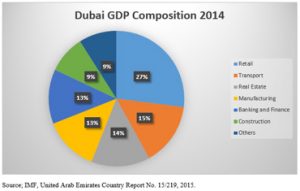

Although the UAE comprises seven emirates, it is Abu Dhabi and Dubai that are better known internationally due to their established infrastructure and business environment. Dubai and Abu Dhabi represent the largest share of the UAE’s GDP: Abu Dhabi contributed 61.8% and Dubai added 21.9% to the total GDP in 2014. Both emirates started their respective diversification strategies based on UAE vision 2020 and both achieved positive results over the past years. In this context, the IMF has praised the Dubai experience in economic diversification.

Dubai

Starting with few natural resources, a small population, and limited infrastructure, the emirate of Dubai has seen remarkable growth and transformation of its economy over the past twenty years. Dubai’s openness to trade, capital and labor inflows—both skilled and unskilled—have served its economy well. The emirate has built a modern infrastructure and instituted a business-friendly environment and regulations to promote the city as a trade and finance hub in the region, especially since the announcement of Expo 2020. It launched projects in aluminium (DUBAL, now part of Emirates Global Aluminium), transportation (Emirates Airlines and two large airports), trade (Jebel Ali Port), Jebel Ali Free Zone has been quite successful. The Dubai model has been emulated by other countries in the region through logistics projects, financial centers and tourism.

Dubai, has been the most proactive player in its attempt at diversification not only in the UAE, but also within the GCC region. The reason for this may relate to its historical commitment to a business-friendly environment, with openness towards foreigners in business and in society in general. Dubai’s GDP is much more diverse in comparison, with the largest sectors being retail (27%), transport (15%), real estate (14%), manufacturing (13%), banking and finance (13%), and construction (9%). The key elements of the ‘Dubai model’ of economic development and diversification include –

(1) government-led development;

(2) fast decision making and ‘fast-track’ development;

(3) a flexible labor force through importing expatriates;

(4) bypassing industrialization and creating a service economy;

(5) creating investment opportunities;

(6) market positioning via branding, and;

(7) development in cooperation with international partners.

Abu Dhabi

Abu Dhabi launched in 2008 the Abu Dhabi Economic Vision 2030, a government roadmap that outlines how it will achieve growth and diversification from the current level of 49.1% to about 64% of GDP contribution in its non-oil sectors by 2030. Abu Dhabi is by far the wealthiest emirate, and sponsors development in the other emirates through its contributions to the federal budget. Abu Dhabi has sought to invest in manufacturing industries such as metals, plastics, fertilizers, petrochemicals.

Abu Dhabi has been successful in creating a conducive to business environment through adequate infrastructure, administrative set-up and incentives for investing the national wealth in a variety of areas that support diversification and help to achieve a competitive edge in the world markets. The economic development in the emirate of Abu Dhabi has been characterized by huge investment in commodity and service activities in a manner that bolstered the diversification of national income sources and the creation of an economic base to support the expansion of private sector participation in productive activities. Moreover, non-oil economic activities have grown between 5% and 8% during the period 2007-2014, which raised its contribution to the real GDP from less than 44% in 2007 to 49.1% in 2014. A careful reading of the indicators confirms that Abu Dhabi’s economy is steadily transforming into a diversified knowledge based economy capable of achieving sustainable development.

The Road to a more Diverse Economy

The UAE Government stepped up action over the last two decades to ensure that UAE nationals are contributing to the labor market. It has sought to change the preference of its citizens away from the public sector, by increasing investments in the private sector. At the same time, it has decreased public expenditures to balance the salaries between both sectors and reduce the burden on the government. The main challenge the Government faces in this respect is continued investment in technology, education, research and development (R&D) to create a more highly skilled and highly motivated Emirati workforce and increase the percentage of knowledge workers in the country to 40% by 2021 to build a vibrant knowledge economy and develop the country economically and socially.

As part of the country’s 2021 vision, the government need to create and enable environment for trade and investment, in particular in the new economic sectors such as aerospace and technology. As the WTO’s recent Trade Policy Review recommends that the UAE may need to accelerate ongoing efforts, such as the full implementation of the Competition Policy Law, easing of restrictions on foreign investment including the requirement of majority ownership by UAE nationals and further improving the business environment to enhance its competitiveness in foreign markets and to develop and promote commercial diplomacy with other countries. In this context, the UAE leadership has to tackle challenges to shape its future. On the whole it needs to continue the diversification of its economy in order to lower its dependency on volatile oil and gas export revenues. As well, the changing dynamics of the economy and the global market crash further reinforced the need for diversification as a big part of its rational risk management strategy.

Comments